Our 2025 Top Startups

Risk

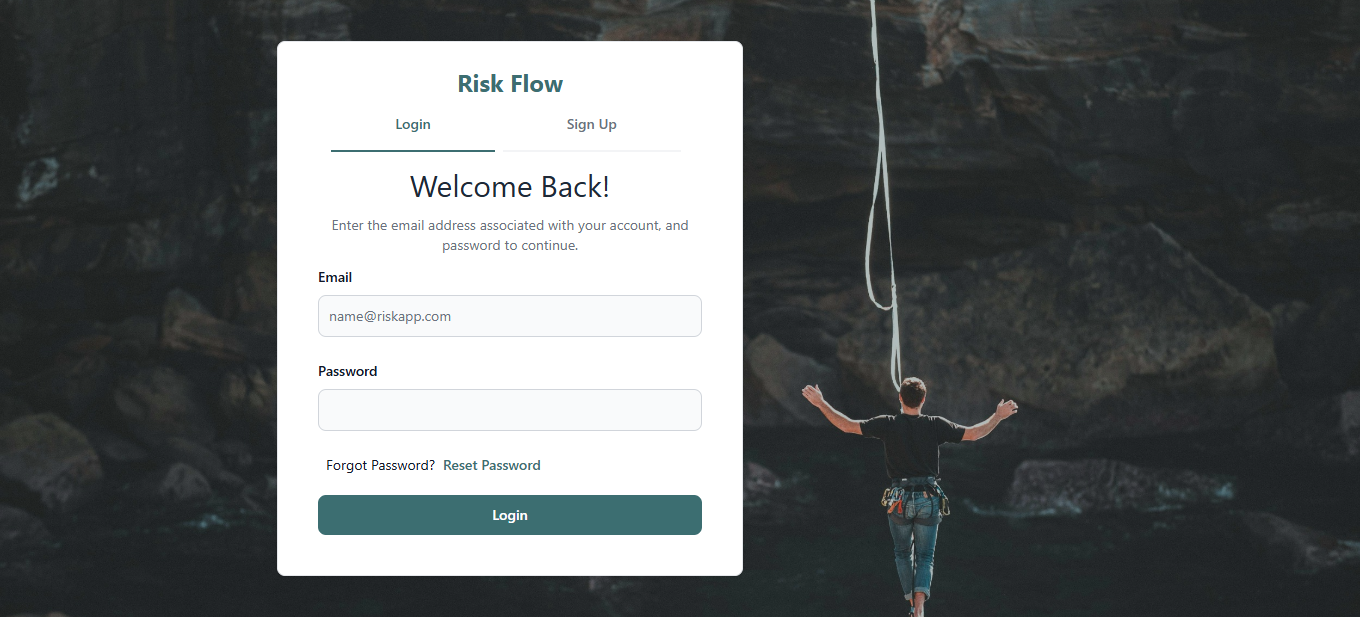

Modernizing Risk Management for Organizations

Risk is a digital platform built to transform how companies and organizations identify, analyze, and manage departmental risks. Traditional risk management often relies on outdated spreadsheets, fragmented systems, and siloed communication—making it hard to track threats and take timely action. Risk replaces that complexity with a centralized, intuitive platform that brings structure, visibility, and control to every level of your organization.

With Risk, institutions can easily register potential risks across different departments, assign risk scores based on severity and likelihood, and track mitigation plans in real time.

The platform promotes collaboration between teams, allowing stakeholders to flag issues, add context, and stay informed—all in one place. Whether it’s compliance, operational, reputational, or financial risk, Risk gives you the tools to understand and respond before issues escalate.

Risk is built for simplicity and flexibility. Organizations can customize risk categories, scoring models, and workflows to match their internal policies. Dashboards and reports make it easy to visualize trends, audit risk performance, and make informed decisions with confidence.

In summary, Risk is redefining risk management for the digital era—helping organizations proactively identify vulnerabilities, improve accountability, and build resilient systems that can adapt and thrive in an uncertain world.

WhatBot

Automating WhatsApp Conversations for Businesses

WhatBot is transforming how businesses—especially restaurants and local service providers—communicate with their customers by automating WhatsApp conversations. In a world where customers expect instant replies and seamless interactions, traditional phone lines and manual messaging just don’t cut it. WhatBot makes it easy for businesses to manage high volumes of messages, handle bookings, answer FAQs, and drive sales—all through the messaging app their customers already use every day.

Unlike generic chatbots that feel clunky and impersonal, WhatBot is designed specifically for WhatsApp. It’s fast, conversational, and built to understand the common workflows that businesses need—from confirming reservations and sending menu links, to responding to delivery questions or handling customer feedback. It helps businesses stay responsive 24/7 without needing a large support team.

Setup is simple, and the platform is tailored for non-technical users. Businesses can customize flows, add quick replies, and update information on the fly—no coding required. WhatBot helps teams save time, reduce missed messages, and keep conversations organized, all while delivering a smoother, more professional experience for customers.

In short, WhatBot is reimagining WhatsApp as a powerful business tool—giving restaurants and small businesses the ability to scale their conversations, delight their customers, and grow without friction.

CarTrack

A Smarter Platform for Vehicle Tracking and Fleet Management

CarTrack is a powerful and scalable platform built to enhance the way car tracking businesses operate—improving efficiency, boosting security, and simplifying management for both administrators and end users. Designed with flexibility and future growth in mind, CarTrack delivers a seamless, real-time tracking experience across web and mobile platforms.

At the heart of the system are two core components:

- Web Application (Server): The central hub for fleet management. It offers real-time monitoring of vehicles on a live map, tracks movement and speed, logs historical data, and provides a full suite of administrative tools for managing tracking devices and vehicle activity.

- Mobile Application: Built for ease and accessibility, the mobile app mirrors the web experience—empowering users to track vehicles, manage settings, and access historical data anytime, anywhere.

Key Features Include:

- Real-Time Vehicle Tracking: GPS devices installed in vehicles transmit live data to our server, allowing users to track location, movement, and speed with precision.

- Remote Ignition Control: Administrators can remotely switch a vehicle’s ignition on or off directly from the app—replacing the outdated SMS-based control system and enhancing security.

- Geofencing Alerts: Set up virtual boundaries and receive instant notifications when a vehicle enters or exits a designated area—improving control and safety.

- Historical Data & Reporting: All vehicle movements are recorded and stored, enabling detailed activity logs, performance analysis, and easy reporting.

- Multi-Device Compatibility: CarTrack supports a wide range of GPS tracking devices, ensuring compatibility across different vehicle types and models.

- In summary, CarTrack is redefining fleet tracking by offering a modern, all-in-one platform that combines powerful functionality with an intuitive user experience. It helps tracking businesses stay efficient, proactive, and ready for what’s next.

Thebe Finance

Empowering University Students with Financial Freedom

Thebe Finance is a revolutionary financial institution dedicated to empowering university students by providing fair and accessible loans, steering clear of the exploitative practices associated with traditional loan sharks. Recognizing the financial challenges faced by students, Thebe Finance aims to disrupt the industry by offering reasonable interest rates and transparent loan terms tailored to the unique needs of the academic community.

In contrast to the coercive tactics employed by loan sharks, Thebe Finance adopts a student-centric approach, prioritizing the well-being and financial stability of its borrowers. The institution recognizes the diverse financial circumstances of university students and provides personalized loan options that align with their academic journey. Through close collaboration, Thebe Finance ensures that students can comfortably repay their loans, avoiding unnecessary stress during their education.

Understanding that conventional banks may not always cater to students with limited credit history or financial standing, Thebe Finance strives to be inclusive and accessible to all. By offering flexible options, they break down financial barriers and provide a pathway for students to secure the funds they need for education-related expenses. Moreover, Thebe Finance is committed to enhancing financial literacy among students, providing resources and guidance to foster responsible financial habits.

In summary, Thebe Finance is at the forefront of disrupting the financial landscape for university students. By offering fair and accessible loans, embracing a student-centric ethos, and promoting financial education, Thebe Finance empowers students to navigate their academic journeys without falling victim to the exploitative practices associated with traditional loan sharks. The institution is committed to fostering financial freedom, allowing students to focus on their education and build a solid foundation for their future.

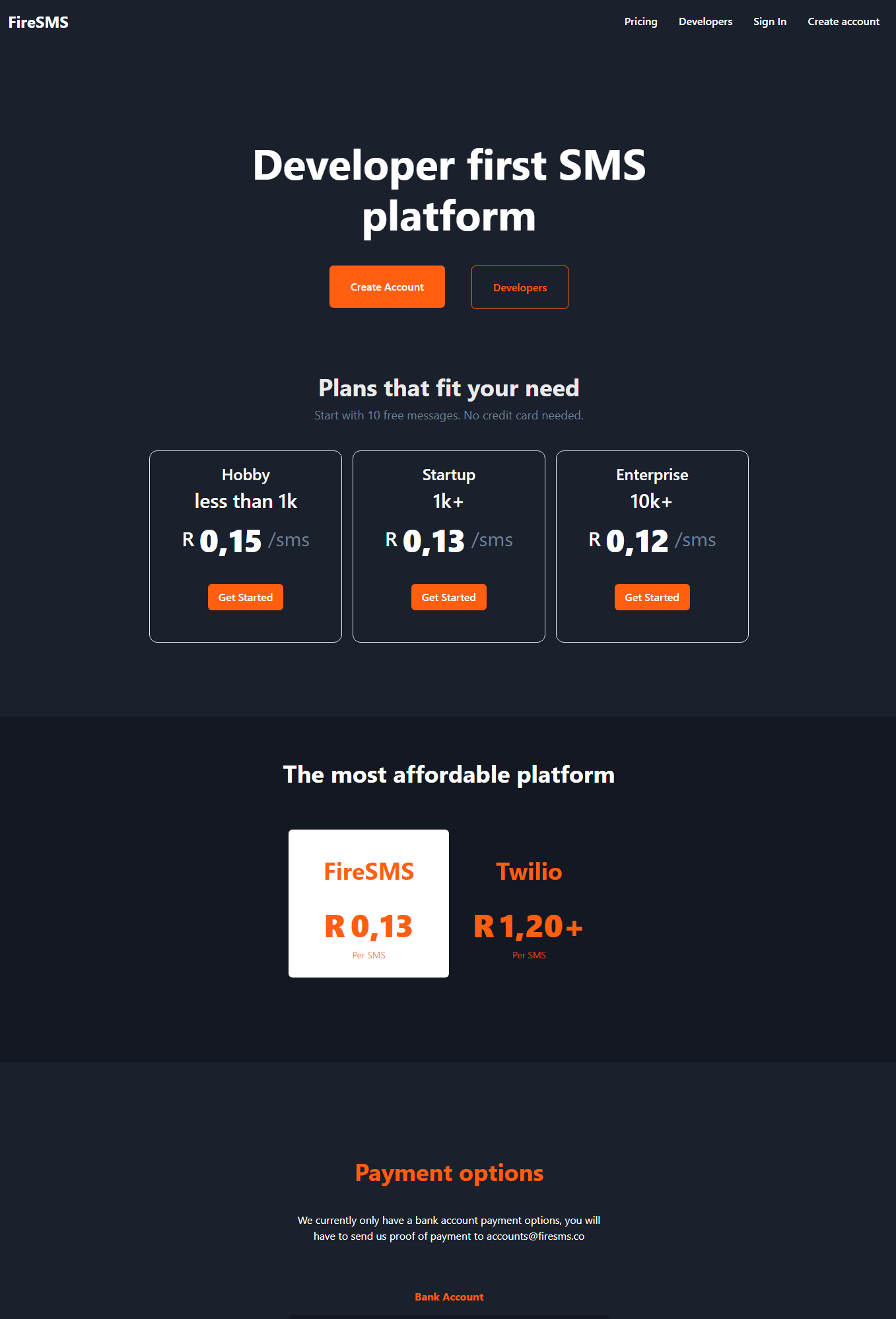

FireSMS

An Affordable SMS Platform For Southern Africa

FireSMS provides an affordable SMS platform for businesses in Southern Africa. With the tagline “An Affordable SMS Platform For Southern Africa,” FireSMS aims to help businesses communicate more effectively with their customers by offering a reliable and cost-effective messaging solution.

SMS (Short Message Service) is a popular way for businesses to communicate with their customers, but many businesses in Southern Africa struggle to find an affordable and reliable SMS platform. FireSMS addresses this issue by offering a platform that is both affordable and reliable, allowing businesses of all sizes to communicate more effectively with their customers.

FireSMS’s platform is easy to use and offers a range of features to help businesses manage their messaging campaigns. This includes the ability to send and receive messages, track delivery status, and customize messages to match the needs of their target audience. The platform also provides analytics and reporting tools to help businesses measure the effectiveness of their messaging campaigns.

In addition to providing an affordable SMS platform, FireSMS is committed to ensuring the privacy and security of customer data. The platform is built with advanced security features to protect sensitive customer information, and FireSMS adheres to strict data protection regulations to ensure the privacy of customer data.

In summary, FireSMS is a technology company that provides an affordable SMS platform for businesses in Southern Africa. By offering a reliable and cost-effective messaging solution, FireSMS helps businesses communicate more effectively with their customers, improve engagement, and drive growth. With a focus on privacy and security, FireSMS is a trusted partner for businesses in Southern Africa.

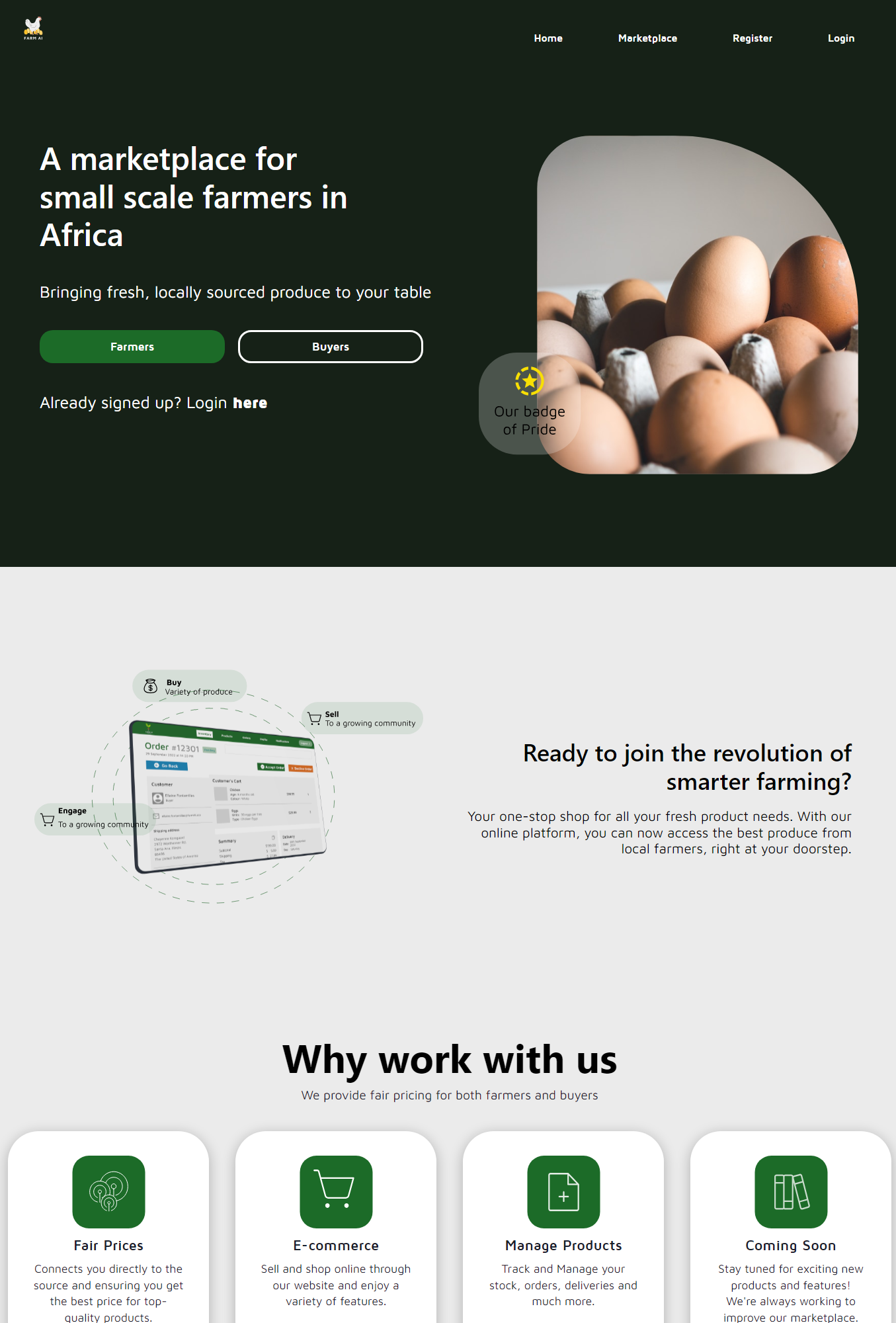

FarmAI

A Marketplace For Small Scale Farmers In Africa

FarmAI has developed a platform for small scale farmers in Africa to connect with buyers and sell their products on a global marketplace. With the tagline “A Marketplace For Small Scale Farmers In Africa,” FarmAI aims to revolutionize the way small scale farmers access markets, ultimately improving their livelihoods and the sustainability of the agriculture industry.

Small scale farmers in Africa often face significant challenges in accessing markets due to limited resources, lack of infrastructure, and inefficient supply chains. FarmAI’s platform addresses these issues by creating a digital marketplace that connects farmers directly with buyers, eliminating intermediaries and reducing transaction costs.

Through FarmAI’s platform, small scale farmers can list their products and connect with buyers from all over the world. The platform also provides tools and resources to help farmers manage their businesses more efficiently, including crop management, logistics, and payment processing. This helps farmers save time and money, allowing them to focus on growing their businesses and increasing their incomes.

In addition to providing a marketplace for small scale farmers, FarmAI is also committed to promoting sustainable agriculture practices that support the environment and local communities. By partnering with farmers, cooperatives, and other stakeholders, FarmAI is working to create a more equitable and sustainable food system that benefits everyone.

In summary, FarmAI is a company that has developed a marketplace for small scale farmers in Africa to connect with buyers and sell their products. By leveraging digital technology and promoting sustainable agriculture practices, FarmAI is helping to empower farmers and create a more equitable and sustainable food system.